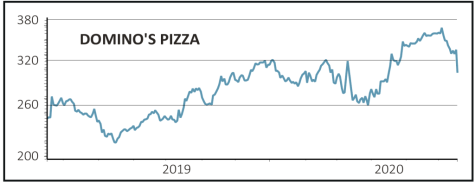

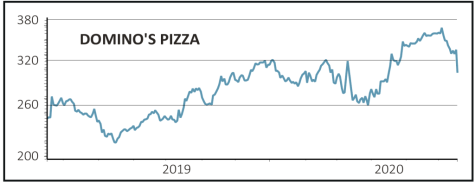

Domino’s Pizza (DOM) 310p

Gain to date: +3.7%

Original entry point: Buy at 299p, 16 April 2020

One of the key attractions of Domino’s Pizza (DOM) during lockdown was the strength of the brand and a rapid move to deliveries which initially more than offset the lack of sales from collections.

In the first week of lockdown the company reported higher orders and greater items per order which raised the average ticket value.

However in a 17 June trading update the company said order count for the first half to 14 June had declined and that a ‘change in consumer purchasing behaviour’ had impacted margins.

Customers have been purchasing a higher proportion of sides and desserts which was good for sales, but they generate lower profit margins for Domino’s.

In addition while UK like-for-like sales growth accelerated from 2.3% before the lockdown to 5.1%, averaging 3.7% for the first-half to 14 June, Ireland has experienced a weaker performance, with like-for-like revenues falling 6%. For the lockdown period like-for-like sales in Ireland fell 9.2%.

Lastly, a significant change to operations in order to protect customers and staff has resulted in considerable additional costs which has more than offset the benefits from higher revenues. Consequently, the company guided for lower first-half earnings before interest, tax, depreciation and amortisation (EBITDA).

We expect analysts to lower their earnings expectations in accordance with the new guidance.

SHARES SAYS: Take profit. Earnings matter more than revenue growth and trading isn’t strong enough to support our previous buy stance.

‹ Previous2020-06-18Next ›

magazine

magazine