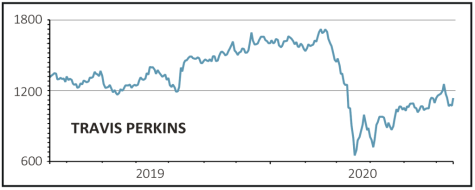

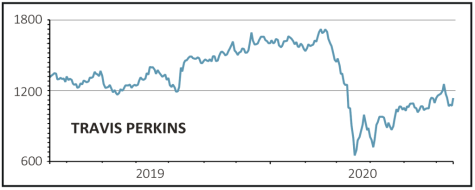

TRAVIS PERKINS (TPK) £11.30

Gain to date: 11.3%

Original entry point: Buy at £10.15, 30 April 2020

The latest trading update from building supplies firm Travis Perkins (TPK) was upbeat on current trends in its industry, but less positive than hoped on the outlook for the UK economy in general and its end markets for the rest of this year and 2021.

While average weekly business volumes are almost back to normal for the group this month, there is a gap between Wickes and Toolstation which are seeing higher like-for-like sales and the Merchanting, Plumbing and Heating businesses where volumes are still some way below last year’s levels.

The firm has taken the tough decision to close 165 branches, mainly in the General Merchanting division, with the loss of up to 2,500 jobs or 9% of the workforce. Cuts will be focused on smaller branches where safe distancing is difficult or where lower volumes will impact overall profitability.

Travis still has ample liquidity, with £363m of cash and £400m of undrawn bank lending, and while laying people off is never pleasant it should ensure the business is streamlined and competitive in what it believes will be tough times ahead for the building industry and suppliers.

SHARES SAYS: Travis has grasped the nettle in order to emerge stronger. We are still buyers.

‹ Previous2020-06-18Next ›

magazine

magazine