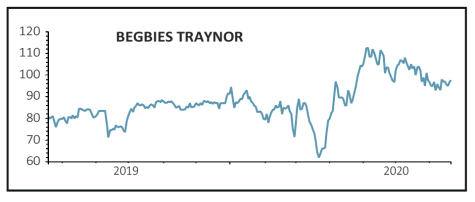

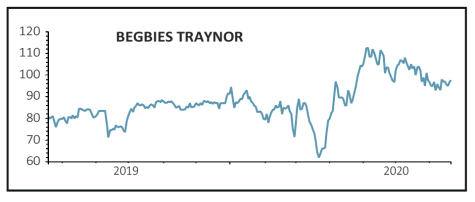

Begbies Traynor (BEG:AIM) 99p

Gain to date: 12.5%

Original entry point: Buy at 88p, 19 December 2019

Insolvency and business recovery firm Begbies Traynor (BEG:AIM) pleased the market on 21 July with an 8% increase in the dividend after posting in-line results for the year to 30 April.

Revenues for the period were £70.5 million, an increase of 17%, of which 5% was due to organic growth and 12% came from acquisitions.

Adjusted pre-tax profits were up 31% to £9.2 million, exactly in line with guidance despite a minor hit from the pandemic.

Its business recovery and financial advisory operations continued to win and progress new cases, and work has increased this quarter although the firm expects its current year results to be weighted towards the second half as the Government removes its support measures and companies begin to struggle.

While lockdown put the brakes on commercial property activity and the sale of businesses, transaction volumes have picked up this quarter but as with recovery and advisory the firm expects insolvency-focused areas to see more work in the second half.

Financially the firm is in good shape thanks to improved cash generation, and following the July 2019 capital raise the firm has almost zero net debt.

SHARES SAYS: Keep buying. Results will improve as the economy slows making Begbies a good portfolio hedge.

‹ Previous2020-07-23Next ›

magazine

magazine