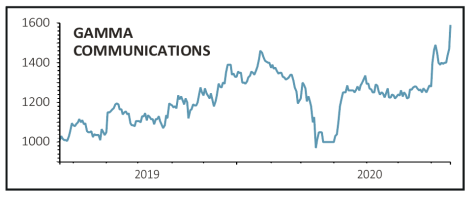

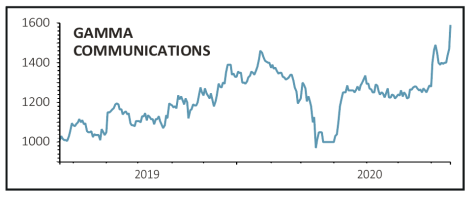

Gamma Communications (GAMA:AIM) £15.35

Gain to date: 2.7%

Original entry point: Buy at £14.95, 9 July 2020

Telling the market that you expect to beat full-year forecasts on earnings and revenue because your core business has performed so well is a pretty good way to impress investors, and Gamma Communications (GAMA:AIM) has done just that.

Consensus for this year had been pitched at £71.8 million of earnings before interest, tax, depreciation and amortisation (EBITDA) on £373 million revenue, but Peel Hunt is among those to raise estimates to £73.5 million and £383.4 million respectively following new guidance from Gamma.

Importantly for the longer-term, the UCaaS business (unified communications as a service) has also continued its European acquisition spree, adding to its footprint in the Netherlands with GnTel, a modest £7.4 million cash bolt-on.

Clearly the work from home theme has been very good for Gamma but with staff slowly returning to offices, it will be worth watching how that might affect the use of products we relied on under lockdown such as Microsoft Teams.

Centralised working could see usage decline, although as Peel Hunt says, this might just as easily make businesses realise that these tools are ‘more important than ever’.

SHARES SAYS: A good start for a very recent addition to our list of top ideas. Keep buying for the long-term.

‹ Previous2020-07-23Next ›

magazine

magazine