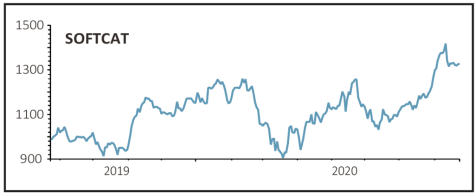

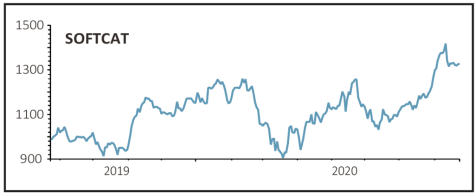

SOFTCAT (SCT) £13.20

Gain to date: 37.5%

Original entry point: Buy at 959.5p, 1 August 2019

Our returns have doubled on software reseller and IT advisor Softcat (SCT) since we last updated on the stock two months ago, demonstrating how this technology enabler has been able to capitalise on Covid-19.

Its latest trading update (19 Aug) emphasised its reputation as a fine growth business. The company flagged the return of a dividend that was originally cancelled in response to the Covid-19 outbreak while adding that full-year operating profit would be ‘slightly ahead’ of expectations.

Worth noting was the strong cash generation, an important factor in its decision to recommit to pay the dividend. Full-year results to 31 July 2020 will be released in late October.

‘This is another robust performance bearing in mind estimates were never downgraded for the pandemic,’ says Numis analyst Tintin Stormont. We can only agree given the firm’s ongoing excellent performance both operationally and in share price terms.

Peel Hunt analyst James Lockyer upped his own earnings estimates for year to 31 July 2020 and 2021 by 4% to 6%, thanks to good cost management.

SHARES SAYS: Softcat continues to repay the faith of investors during a testing time. Still a buy for the longer-term.

‹ Previous2020-08-27Next ›

magazine

magazine