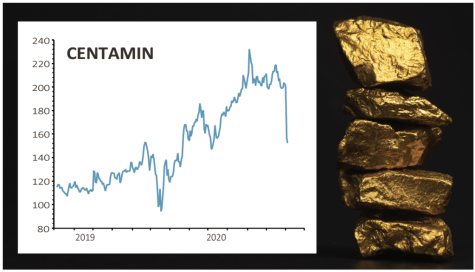

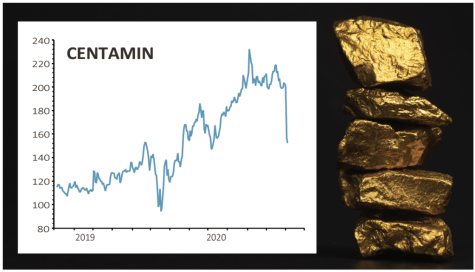

Centamin (CEY) 151p

Gain to date: 14.2%

Original entry point: Buy at 129.6p, 1 August 2019

Shares in gold miner Centamin (CEY) have lost around 25% of their value since 2 October after ground movement forced it to close off an area of its Sukari mine, hurting its production output and damaging its ability to profit from the rally in the gold price.

Centamin had to halt operations at the Sukari open-pit Stage 4 West wall as a safety measure, and as a result says fourth quarter gold production will fall to 70,000 ounces.

Considering Sukari is Centamin’s only mine, any operational problems at the site will be felt more keenly than peers who produce gold from numerous mines.

Analysts at Berenberg said the changes would reduce production for 2020 to 444,000 ounces of gold versus 516,000 ounces previously, a 14% reduction, and would push up Centamin’s all-in sustaining costs from $903 per ounce of gold to $1,039 per ounce, a 15% increase.

They added the ‘bigger concern’ is that it could necessitate a redesign at Sukari ‘based on shallower pit angles with higher resultant strip, which would have a negative impact on costs and free cash flow generation’.

SHARES SAYS: Take profits. We’ll reconsider our stance on the stock once we know if there’s a bigger problem at Sukari or not.

‹ Previous2020-10-08Next ›

magazine

magazine