Investing in emerging markets involves encountering a different set of risks than those experienced in developed countries, including when it comes to governance.

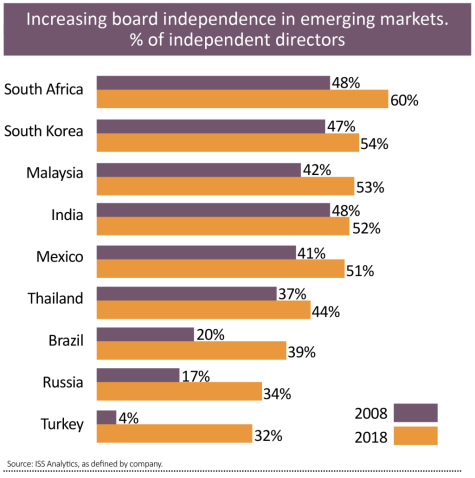

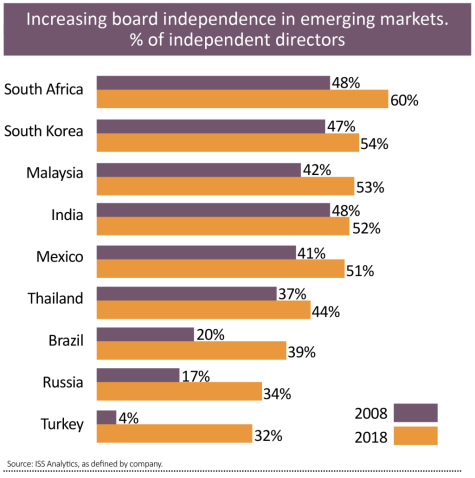

This reflects both the regulatory framework for capital markets in emerging market countries and the structures of ownership which are more prevalent in these countries. Governance is improving as these markets mature, with measures like board independence broadly heading in the right direction.

A report by Melsa Ararat and George Dallas for the Global Corporate Governance Forum encapsulates the situation neatly. ‘Corporate governance remains a key risk factor for investors in emerging markets and an important determinant of portfolio investment decisions,’ it notes.

‘This is the case at both the country level, where rule of law, regulatory quality, and corruption are key drivers for country-level risks, and at the firm-specific level, where controlling shareholders (state, families, or other financial or industrial groups) play a decisive role and are a source of strength or weakness. These risks are relevant to equity investors and fixed-income investors.’

Most individual investors would invest in emerging market firms’ equity or bonds through funds and the institutions behind these products can play a part in addressing governance risks.

Ararat and Dallas say risks can be mitigated by informed voting and engagement of investors with companies and regulators.

A 2019 report on corporate governance by Institutional Shareholder Services executive director Subodh Mishra said: ‘Despite the significant corporate governance challenges shareholders face in emerging markets, they have several tools in the repository to address potential concerns.’

Steps highlighted by Mishra include doing due diligence on ownership structures and items such as related party transactions.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here.

‹ Previous2020-10-29Next ›

magazine

magazine