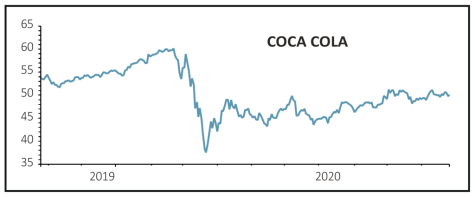

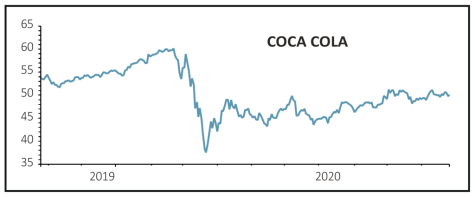

THE COCA-COLA COMPANY (KO:NYSE) $49.80

Gain to date: 2.7%

Original entry point: Buy at $48.48, 30 July 2020

Some of the froth was knocked off of The Coca-Cola Company’s (KO:NYSE) shares in the recent Wall Street sell-off, though we’re pleased to see they broke $50 beforehand following our summer ‘buy’ call on the beverages behemoth and our trade remains 2.7% in the money.

Encouragingly, the James Quincey-steered drinks colossus’s third quarter earnings beat expectations with a boost from elevated at-home demand, even as the pandemic weighed on away-from-home volumes.

For the third quarter to September, organic sales softened 6%, yet that represented a dramatic improvement from the second quarter’s 26% decline and net sales dropped 9% to a better than expected $8.65 billion.

The New York-listed giant behind the world’s most recognisable soft drink has cut costs and is slimming its drinks portfolio, cutting drinks like Tab in order to focus on best- selling brands.

We continue to like Coca-Cola as a compelling recovery and total returns play, given its proven pedigree in surviving challenging periods and emerging stronger.

SHARES SAYS: We’re staying sweet on The Coca-Cola Company. Keep buying.

‹ Previous2020-10-29Next ›

magazine

magazine