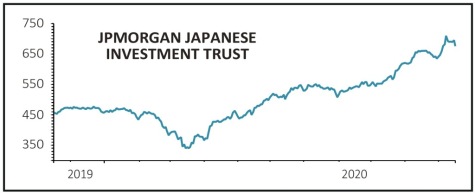

JPMORGAN JAPANESE INVESTMENT TRUST (JFJ) 688p

Gain to Date: 25.6%

Original entry point: Buy at 547.92p, 02 July 2020

Our bullish call on JPMorgan Japanese Investment Trust (JFJ) is now 25.6% in the money and we remain positive on the capital growth-focused fund, confident that managers Nicholas Weindling and Miyako Urabe will continue to find the most attractively valued Japanese investment themes and companies in an under-researched stock market.

Back in July, we highlighted the trust’s then 10.2% discount to net asset value (NAV), which we believed belied a strong long-run record. According to Quoteddata, this has been achieved ‘by following a conviction-driven stock-picking approach that focuses on quality and growth, two aspects that have been in demand in a world tackling Covid-19’.

That discount has narrowed to 1.18% with investors increasingly recognising the trust’s merits and sentiment towards Japan turning more positive, boosted by Japan’s better than forecast third quarter GDP reading.

SHARES SAYS: Stick with JPMorgan Japanese Investment Trust.

‹ Previous2020-11-19Next ›

magazine

magazine