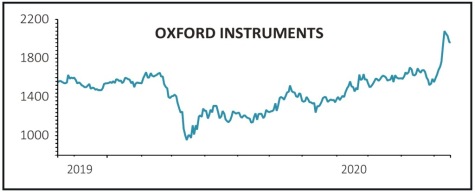

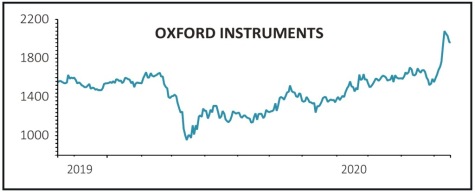

OXFORD INSTRUMENTS (OXIG) £19.64

Gain to date: 44.1%

Original entry point: Buy at £13.60, 7 November 2019

While the surge in other stocks have grabbed headlines Oxford Instruments (OXIG) has relatively quietly gone about its business, paying off brilliantly for investors.

The cutting edge science tools designer and maker has demonstrated beyond doubt its world class expertise and the enormous value it brings to the wider scientific community.

This comes as no surprise to Shares. Living in a world of climate change, ageing populations, pressure on food and water supplies and depleting raw materials, mankind is facing some of the stiffest challenges in its 200,000-odd year history. Oxford Instruments remains among the leading lights in arming scientific boffins, health researchers and technology trailblazers with the tools to meet these tests.

Which makes us confident that even trading on a March 2022 price to earnings (PE) multiple of 28.5, the company’s growth, margin expansion and free cash flows continue to make this a great stock to own for years to come.

SHARES SAYS: Forecast upgrade potential remains high, still a buy for the long-run.

‹ Previous2020-11-19Next ›

magazine

magazine