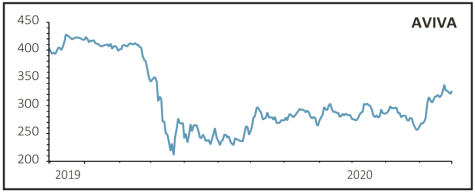

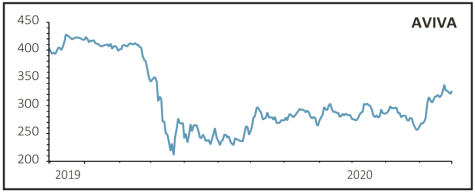

AVIVA (AV.) 326p

Gain to date: 8.3%

Original entry point: Buy at 301p, 17 September 2020

November brought a raft of good news from the UK’s largest insurer in the shape of resilient nine-month earnings and news of two disposals for a combined £2 billion.

Trading to the end of September saw a strong performance from the UK and Irish life business as well as positive net fund flows in the savings and retirement business.

In the commercial market, the firm increased its premiums through higher rates and targeted growth, while it reduced its individual premiums as it targeted a more profitable, tightly-run portfolio.

With its Solvency II coverage ratio of 195%, and a policy of returning excess capital above 180% to shareholders, the firm proposed a 2020 dividend of 21p per share which it said would grow by ‘low to mid single digits’.

Although this was a steep drop compared with prior years, investors took the news well and shares continue to make six-month highs.

Chief executive Amanda Blanc reiterated her commitment to ‘simplify the business’ and increase value for shareholders, which she carried through with the earlier than expected monetisation of the Singaporean life business and the sale of a majority stake in the Italian life business.

Further disposals in Italy, France and Poland are mooted, which should guarantee the firm’s Solvency coverage ratio going forward.

SHARES SAYS: We remain positive. Keep buying.

‹ Previous2020-12-03Next ›

magazine

magazine