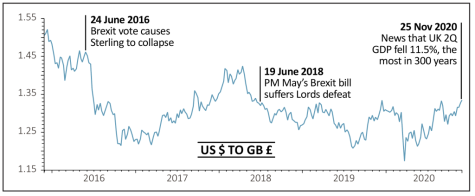

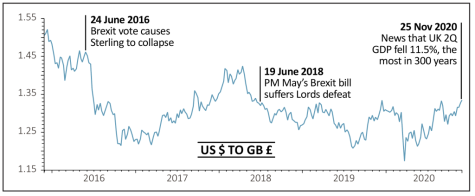

In a scenario which most people involved with markets never imagined, let alone predicted, the pound is about to reach an important trading level as hopes increase of a UK trade deal with the EU.

Having collapsed to just above $1.15 to the dollar at the height of the panic selling in March, sterling has muscled its way back to its pre-pandemic highs of $1.34 and investors with an eye on currencies will be watching to see if has the momentum to head closer to $1.40.

The rally in the pound is in spite of the worst contraction in UK economic output in over 300 years, one of highest mortality rates from coronavirus in the developed world, and the lingering threat of a ‘no-deal’ Brexit which could see the country facing World Trade Organisation tariffs on everything from toilet rolls to cars.

After the original Brexit vote in 2016, UK investors have seen the value of their overseas holdings eroded due to successive waves of sterling weakness. On the other hand, UK companies which do most of their business in the US or export most of their products in dollars have benefitted from the weakness of the currency as overseas earnings are converted back into pounds.

A move back to a higher trading band would therefore enhance returns for UK investors owning dollar assets, but at the same time reduce profits for big overseas earners. Obvious casualties would be firms such as Ashtead (AHT) and Ferguson (FERG), which generate most of their sales and earnings in North America.

According to FTSE Russell, 62% of FTSE 100 revenues are generated overseas, and even the FTSE 250, which is more domestically focused, still generates 35% of sales from outside the UK.

It’s worth considering how exposed your portfolio may be to overseas earnings and to prepare for more warnings from companies about ‘currency headwinds’ as we move into 2021.

‹ Previous2020-12-03Next ›

magazine

magazine