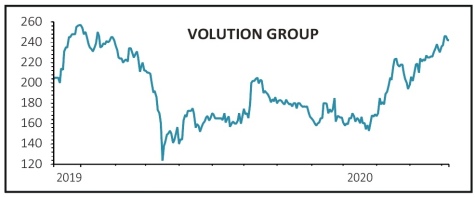

Volution (FAN) 244p

Gain to date: 35.2%

Original entry point: Buy at 180.5p, 9 July 2020

News of positive trading and a new sustainability-linked debt facility have given a lift to Volution’s (FAN) share price.

The company says favourable revenue and margin trends seen in late summer have continued into October and November. Further information will be published on 11 December when it updates the market in more detail on trading.

It has replaced a £120 million revolving credit facility with a new one for £150 million with the option to increase it by a further £30 million. Liberum analyst Charlie Campbell says the increased size of the facility is ‘a clear signal’ of continuing appetite for acquisitions.

The sustainability targets linked to the debt facility are to increase the percentage of sales from low-carbon products from 59% in 2020 to 70% by 2025, and increase the percentage of plastic processed in its factories from recycled sources from 56% in 2020 to 90% by 2025.

Hitting these targets results in interest savings which would then be used by Volution to invest in its sustainability initiatives and programmes.

‘Volution is keeping pace with the leaders in the building products and materials universe: Kingspan (KGP) issued a Green private placement in September and LafargeHolcim a sustainability bond in November,’ says Campbell.

SHARES SAYS: We’re encouraged by the progress so far.

‹ Previous2020-12-10Next ›

magazine

magazine