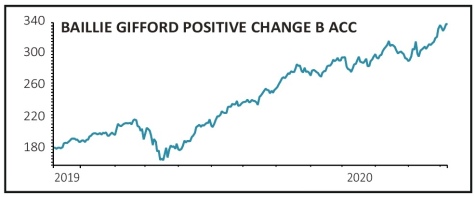

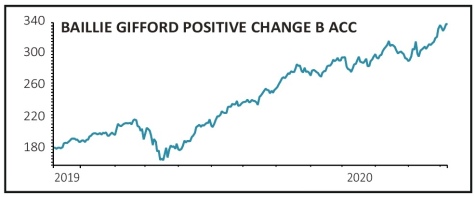

Baillie Gifford Positive Change (BYVGKV5) 338.2p

Gain to date: 59.2%

Original entry point: Buy at 212.5p, 7 May 2020

Many investors shun funds in the belief they will get a better return from picking individual stocks. Baillie Gifford Positive Change (BYVGKV5) is proof that funds can deliver superior returns, with a near-60% gain since we said to buy in May.

Launched in January 2017, the fund has ranked in the top quartile for performance on a six-month, one year and three-year basis, according to FE Fundinfo.

The managers believe that every company within the portfolio has the potential to deliver positive impact as well as strong financial returns. It invests in high-quality companies whose products or behaviour can aid education, social inclusion, healthcare and the environment. That seems like a great space for investors.

Tesla’s 300%-odd rally since early May has helped the fund’s performance this year, but there have been other strong performers among the stocks in its portfolio, such as healthcare names like Teladoc and Illumina, and Covid-19 vaccine hopeful Moderna.

No fund will enjoy success all the time with every holding. Like other funds in the Baillie Gifford stable, the fund managers are very patient and are happy to sit through any bad periods for portfolio companies providing the fundamental investment and impact case remains intact.

SHARES SAYS: There’s a strong team sitting behind this fund. Still a buy for the long-term.

‹ Previous2020-12-10Next ›

magazine

magazine