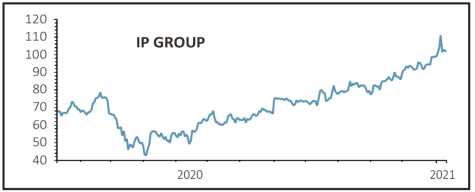

IP Group (IPO) 100.8p

Gain to date: 21.4%

Original entry point: Buy at 83p on 15 October 2020

Since we turned positive on the developer of intellectual property-based businesses IP Group (IPO), several positive developments have propelled the shares from a 15% discount to net asset value to the current 5% as estimated by Berenberg.

The portfolio’s largest holding Oxford Nanopore has made good progress on the development of its real time Covid-19 testing product LamPORE securing a multi-year UK government contract which could be worth double the firm’s 2019 revenues.

Berenberg reckons that Oxford Nanopore is well positioned to go public via an initial public offering sometime this year which would provide ‘substantial returns’ and another cash realisation for the group.

In early December portfolio company Artios announced a strategic collaboration with German Pharmaceutical firm Merck KGaA on developing novel DNA Damage Response targets in cancer. Artios will receive a $30 million upfront payment and is eligible to receive up to $860 million for each target as well as royalty payments.

Portfolio company Hinge Health completed a $300 million funding, valuing the company at around $3 billion and IP Group’s stake at £42.1 million representing an unrealised gain of roughly £30.7 million.

SHARES SAYS: We remain buyers of IP Group. [MG]

‹ Previous2021-01-14Next ›

magazine

magazine