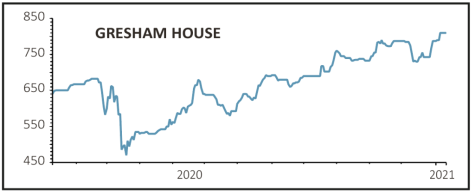

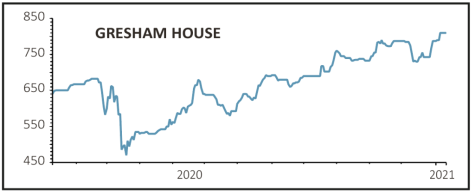

Gresham House (GHE:AIM) 810p

Gain to date: 29.2%

Original entry point: Buy at 627p, 23 July 2020

Last month’s purchase by Gresham House (GHE:AIM) of Irish alternative asset manager Appian for a total potential outlay of €10 million isn’t just a case of management seizing an opportunity to add critical mass on the cheap, although the price certainly looks attractive.

Appian is a well-established, active manager in its own right with €330 million of assets invested across various strategies including equities, property, infrastructure and forestry, which aligns neatly with Gresham House’s own approach.

Of particular note is the Appian Burlington Property Fund, which invests in suburban Dublin and major regional centres and which won the MSCI UK and Europe Property Investment Award for Ireland last year.

The deal diversifies Gresham’s asset base outside the UK, while also providing an EU base so that it can continue to access continental clients and funding in a post-Brexit world.

In exchange, Gresham brings Appian its know-how, branding, distribution, and opportunities to cross-sell products, as well as its expertise in social housing in the lead-up to the launch of Appian’s shared-ownership housing fund.

SHARES SAYS: This is a smart move and confirms our faith in management. [IC]

‹ Previous2021-01-14Next ›

magazine

magazine