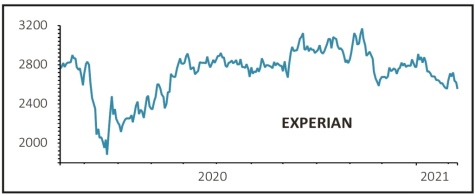

Experian (EXPN) £26.40

Loss to date: 14%

Original entry point: Buy at £30.69, 15 October 2020

Our buy on Experian (EXPN) hasn’t worked out so far but we’re sticking with it as a play on the global reopening and a ‘levelling up’ of consumers through the introduction of progressive new products.

The business to business division, which represents around a fifth of revenue, has struggled during the pandemic, especially with regard to the car industry which has seen sales – and therefore credit applications – shrink dramatically.

However, the consumer business still accounts for nearly 80% of turnover and in the US – its biggest market – the firm has positive tailwinds from president Biden’s call for socially inclusive growth, although were it to occur the creation of a federally-backed public credit bureau would be negative.

In Brazil, another key market, the law allowing the collection of ‘positive’ credit data is driving an uptake of Experian’s credit-scoring product and allowing consumers to improve their score and obtain affordable credit.

Bank accounts and credit card penetration in Brazil are at much lower level than the US or the UK, and studies have shown that when people are included in the financial system they are more able to support themselves through financial shocks.

SHARES SAYS: The recent sell-off is a good opportunity to add to positions.

‹ Previous2021-02-11Next ›

magazine

magazine