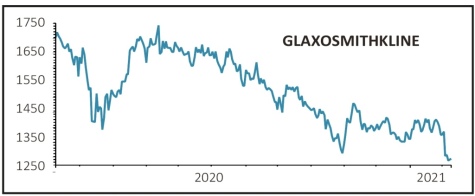

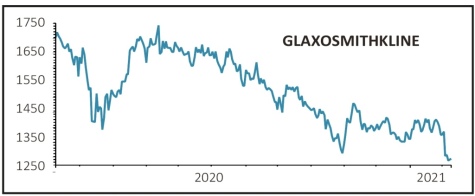

GlaxoSmithKline (GSK) Price £12.70

Loss to Date: 3.9%

Original entry point: Buy at £13.21 on 5 November 2020

While GlaxoSmithKline (GSK) reported (3 Feb) full year 2020 adjusted profits in line with guidance, down 4% at constant currencies, the company pushed any meaningful improvement in revenues and profits out to 2022.

The new guidance reflects increased investment in the drug pipeline and a deferral of strong growth in the vaccine division due to the impact of the Covid-19 immunisation programmes on other rounds of inoculations. Most notably the shingles vaccine which is aimed at the elderly.

However, the results also provided evidence of good strategic progress. The respiratory franchise grew slightly as sales of new products overtook legacy products for the first time in several years.

The cancer franchise showed good momentum with Zejula (ovarian cancer) growing 48% and Blenrep (multiple myeloma) reporting £33 million in sales after launching in the third quarter of 2020.

GlaxoSmithKline expects more than 20 new product launches by 2026 with potential peak revenues of more than $1 billion.

Following the separation of Consumer Healthcare in 2022 the company will review its dividend policy.This makes sense and is designed to drive growth in the Biopharma pipeline. Glaxo will provide more details on asset allocation priorities in June.

SHARES SAYS: The attractions remain in place and investors should buy on current share price weakness.

‹ Previous2021-02-11Next ›

magazine

magazine