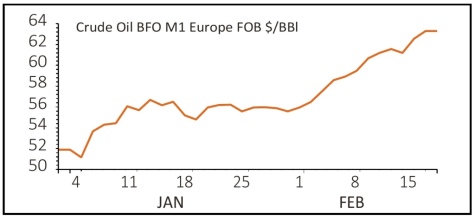

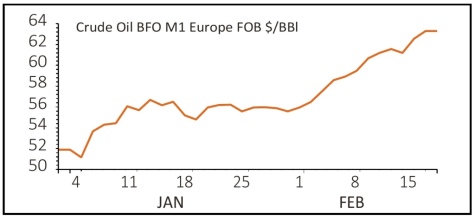

New threats to supply and recovery hopes pegged on vaccine roll-outs and US stimulus are helping oil prices extend their stunning start to 2021.

As we write this is contributing to big gains for the FTSE 100 thanks to the heavyweight status of BP (BP.) and Royal Dutch Shell (RDSB) on the index.

While the demand recovery story is a medium-term one, the problems on the supply side, other than the planned quotas imposed by producers’ cartel OPEC and Russia, appear to be more short term in nature.

The freezing temperatures in Texas which have disrupted oil production are starting to ease and tensions in the Middle East seem to have simmered down for now.

Though there are apparent signs of speculators moving into the oil market, following in the wake of the recent GameStop phenomenon, which could provide another leg to the oil price rally.

This rally has helped Shell to recover its losses after investors gave the thumbs down to its 11 February strategy update with Berenberg noting that for all the talk on the energy transition the renewables arm ‘remains the division with the lowest return target for the company’.

‹ Previous2021-02-18Next ›

magazine

magazine