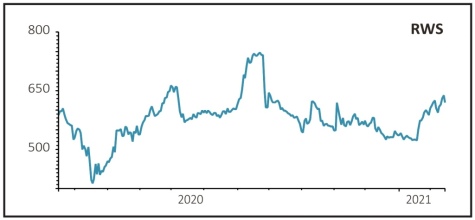

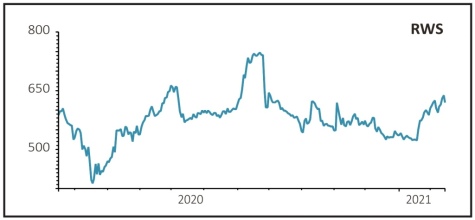

RWS (RWS:AIM) 619p

Gain to date: 15.9%

Original entry point: Buy at 534p, 23 December 2020

Language translation technology firm RWS (RWS:AIM) signaled to the market this month that trading in its core business in the first quarter to the end of December had been ‘excellent’, with pre-tax profit up by double digits.

At the same time, in its first two months as part of the group, new acquisition SDL delivered results in line with the previous year and the integration process is well on track, with new management already in place and ‘significant synergies already starting to be realised’.

The firm held off from raising its full year forecasts and instead flagged the strength of sterling against the US dollar as providing ‘an unwelcome headwind’, but the strong start suggests there could be broker upgrades in the pipeline.

Moreover, given RWS has no net debt, chairman Andrew Brode hinted at more deals to come, calling the firm ‘well-positioned to take advantage of further acquisition opportunities in a rapidly consolidating market segment’.

Numis sees the stock as ‘good value’ given the encouraging trading update and especially the potential for higher than expected synergies to come from the SDL acquisition.

SHARES SAYS: Keep buying.

‹ Previous2021-02-18Next ›

magazine

magazine