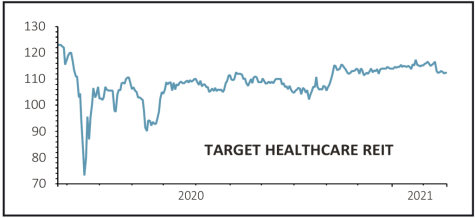

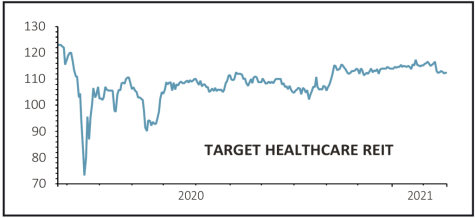

Target Healthcare REIT (THRL) 112.4p

Gain to date: 5.2%

Original entry point: Buy at 106.8p, 16 July 2020

Care home investor Target Healthcare REIT (THRL) may not have knocked the lights out in terms of share price performance since we flagged it in July 2020 but the steady gains in the interim look a decent outcome given the pressures on the sector from Covid-19.

The REIT has remained a reliable source of income through the period, maintaining its progressive dividend policy.

As chief executive Kenneth MacKenzie tells Shares, the pandemic has made the case for its focus on purpose-built facilities with en-suite wet rooms given the increasing importance of infection control.

With vaccinations happening across care homes the level of enquiries across its portfolio is ramping up, which should help rebuild occupancy levels.

In this context Target recently announced plans to raise £50 million to invest in a pipeline of £224 million worth of existing assets and development opportunities.

MacKenzie says the expansion plans will help boost the number of tenants and thereby diversify the risk on its income stream.

SHARES SAYS: The shares continue to offer a highly attractive 6% yield and are well placed in a space which benefits from structural growth drivers.

‹ Previous2021-02-25Next ›

magazine

magazine