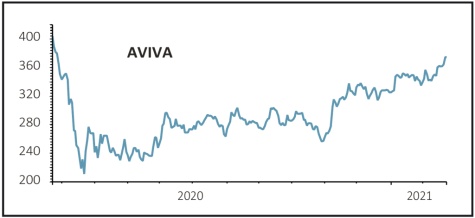

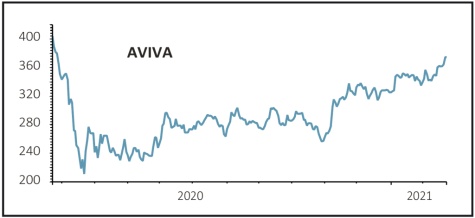

Aviva (AV.) 379p

Gain to date: 25.9%

Original entry point: Buy at 301p, 17 September 2020

Chief executive Amanda Blanc’s mission to transform Aviva (AV.) into a business focused on the UK, Ireland and Canada took another step forward this week with the sale of the French business to local insurer Aema Groupe.

The deal brings in €3.2 billion (around £2.6 billion), increasing the firm’s excess capital above the Solvency II cover ratio by £2.1 billion, giving it further scope to reduce debt, make long-term growth investments and return cash to shareholders.

It also removes a highly capital-intensive business which exposed the group to unnecessary volatility and interest rate risk through its Eurofonds guaranteed life insurance product and yet which didn’t pay out dividends.

‘The sale of Aviva France is a very significant milestone in the delivery of our strategy.

‘It is an excellent outcome for shareholders, customers, employees and distributors. The transaction will increase Aviva’s financial strength, remove significant volatility and bring real focus to the group’, commented Blanc.

The disposal of the French unit follows the sale of businesses in Hong Kong and Vietnam last December and in Italy and Singapore the month before that.

SHARES SAYS: The market clearly likes the CEO’s plan, as do we.

‹ Previous2021-02-25Next ›

magazine

magazine