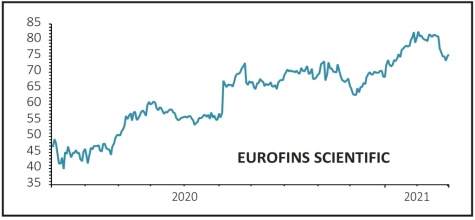

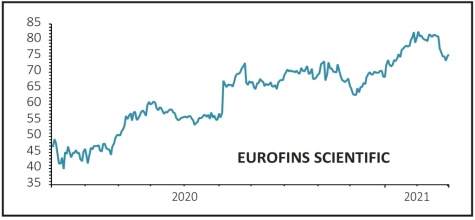

Eurofins Scientific €75.29

Gain to date: 7.6%

Original entry point: Buy at €69.99, 23 December 2020

French firm Eurofins Scientific is the world leader in laboratory testing for products such as pharmaceuticals and cosmetics, as well as being a world leader in environmental certification.

French firm Eurofins Scientific is the world leader in laboratory testing for products such as pharmaceuticals and cosmetics, as well as being a world leader in environmental certification.

The company’s full year 2020 results which were not just above market forecasts but ahead of its own goals which it only set in December, thanks to an exceptional fourth quarter.

Due to its scale and capability, Eurofins has been at the forefront of vaccine testing over the past few months, as well as having developed its own diagnostic kits to identify different Covid variants.

For now, it has left its 2021 forecasts unchanged, although the chief executive admits this year’s results could be ‘materially higher’ if Covid testing continues at current rates, suggesting the risk to estimates is to the upside.

The firm has raised its 2022 and 2023 forecasts, excluding any benefit from Covid testing, as its core businesses have outperformed expectations through the pandemic. It sees scope for further revenue upgrades in the event it makes one or two bolt-on acquisitions.

The recent ‘flight from quality’ has seen the shares pull back so this is an ideal time to add before the price makes new highs on the raised targets.

SHARES SAYS: Everything is pointing in the right direction. Buy.

‹ Previous2021-03-04Next ›

magazine

magazine French firm Eurofins Scientific is the world leader in laboratory testing for products such as pharmaceuticals and cosmetics, as well as being a world leader in environmental certification.

French firm Eurofins Scientific is the world leader in laboratory testing for products such as pharmaceuticals and cosmetics, as well as being a world leader in environmental certification.