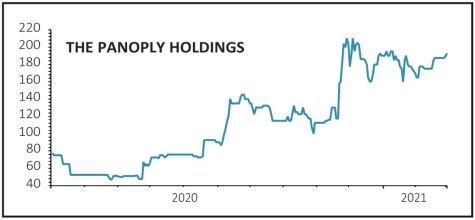

THE PANOPLY HOLDINGS (TPX:AIM) 189p

Gain to date: 110%

Original entry point: Buy at 90p, 6 August 2020

Digital transition business The Panoply Holdings (TPX:AIM) has made its biggest acquisition so far with the £26 million cash and shares purchase of Keep It Simple (KITS).

The managed services supplier to public sector organisations will do three things for Panoply. First, it adds digital transformation engineering expertise in the ‘go-live’ end of IT projects, allowing Panoply to bid for much bigger contracts, up to £20 million in time.

Second, it brings a £30 million backlog of annuity income with departments such as the rural Payments Agency (which pays government subsidies to UK farmers) and DEFRA, and one-third boost to earnings at a stroke, according to Panoply chief executive Neal Gandhi.

Lastly, using its highly rated paper to part fund the deal (£18.5 million) will widen the share register and improve the liquidity of the stock (i.e. how easy it is to buy and sell).

This looks like a great deal for the company and its investors as central and local government (and the private sector) continue their nascent digital push. Stifel raised its March 2022 earnings per share (EPS) forecast from 6p to 7.7p, implying a price to earnings multiple of 24.5.

SHARES SAYS: Still a buy.

‹ Previous2021-03-04Next ›

magazine

magazine