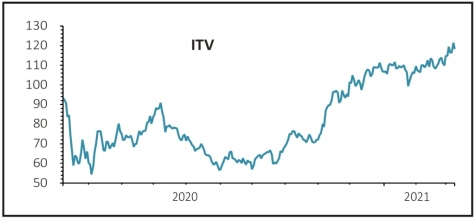

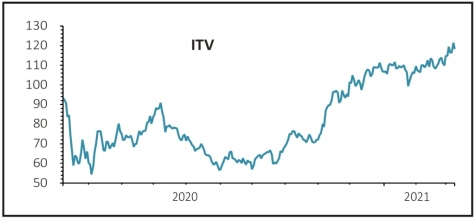

ITV (ITV) 123.9p

Gain to date: 63%

Original entry point: Buy at 76p, 30 April 2020

Our positive call on free-to-air broadcaster ITV (ITV) is handsomely in the money despite a mixed set of full year numbers on 9 March.

The company is seen as a big beneficiary of a reopening of the economy as advertising spend should increase.

Total advertising, which includes online video on demand and sponsorship, is forecast by ITV to be up an eye-catching 60% to 75% in April.

The easy comparatives should support investor interest, particularly with the delayed Euros football tournament likely to provide another fillip should it go ahead.

However, we will still keep a close eye on the shares, because some of the longer-term implications of the latest financial results are less favourable.

The company’s audience share fell and the lack of a big name programme like Love Island to bolster its streaming credentials saw online viewing drop 5%, despite having a captive audience in lockdown.

Its Britbox streaming joint venture may be growing but 2.6 million global subscribers is a drop in the ocean compared with its big global rivals in a highly competitive market.

SHARES SAYS: Short term this is still a buy but we plan to revisit the longer-term investment case later this year.

‹ Previous2021-03-11Next ›

magazine

magazine