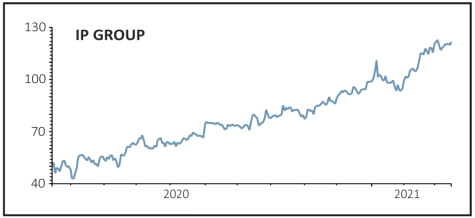

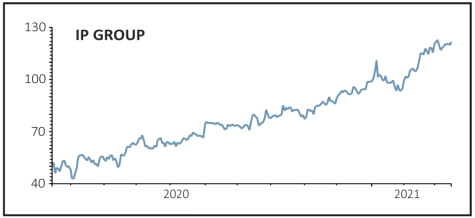

IP Group (IPO) 122.6p

Gain to date: 47.7%

Original entry point: Buy at 83p, 15 October 2020

Developer of intellectual property-based ventures IP Group (IPO) is trading at its highest level since 2018, rewarding our positive call on the stock in October 2020.

The latest run for the shares followed a strong set of full-year results (10 Mar). The company even unveiled a maiden dividend after swinging to an annual profit as portfolio gains boosted net asset value.

Jefferies notes IP Group’s 15% stake in its main holding, biotech Oxford Nanopore, is being valued ‘well short’ of the investment bank’s estimated $5.4 billion valuation for the company.

IP Group’s net assets increased 16% to £1.3 billion or 125.3p per share during 2020 and it saw record cash realisations of £191 million from its investments.

The company is to seek approval to undertake share buybacks should the shares trade below net asset value per share.

Numis analyst Stefan Hamill commented: ‘Two new unicorns emerged in the portfolio, Ceres Power (CWR:AIM) and Hinge Health, validating IP Group’s ability to identify and build winners beyond Oxford Nanopore.’

SHARES SAYS: Still a buy.

‹ Previous2021-03-18Next ›

magazine

magazine