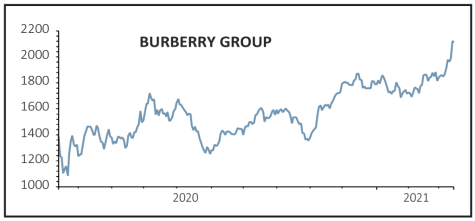

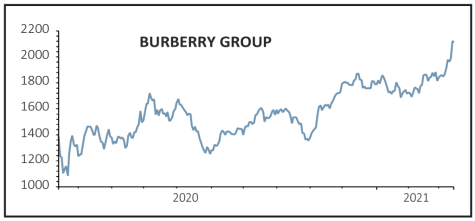

Burberry (BRBY) £21.29

Gain to date: 30.3%

Original entry point: Buy at £16.34, 19 Nov 2020

Our positive stance on luxury goods firm Burberry (BRBY) is paying off, with the shares getting a nice boost after the group said trading is ahead of expectations.

We felt the gradual reopening of the economy would be a useful catalyst for Burberry and that has undoubtedly proved the case, with fourth quarter like-for-like retail sales expected to be ‘in the range of 28% to 32% higher than the same period last year’. Annual sales and adjusted operating profit will come in ahead of forecasts.

This is impressive considering the company is just at the start of a multi-phase bounce back. The company is yet to see one of its key demographics – free-spending Asian customers visiting other countries – come back thanks to travel restrictions.

This, plus a potential new ‘roaring twenties’ style boom as wealthy people splash their cash, gives us confidence that there is more upside on offer.

Our view chimes with that of fund manager Nick Train who, in recent commentary on his Finsbury Growth & Income (FGIT) investment trust, noted: ‘Burberry still looks like an excellent way to participate in wealth creation and recovery in consumer spend, especially in Asia.’

SHARES SAYS: Burberry’s recovery has further to go, keep buying.

‹ Previous2021-03-18Next ›

magazine

magazine