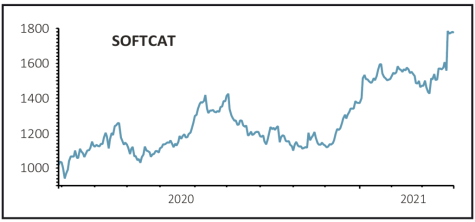

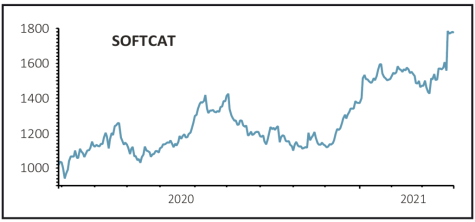

SOFTCAT (SCT) £17.73

Gain to date: 84.8%

Original entry point: Buy at 959.5p, 1 August 2019

There is still ‘significant upside risk to gross profit’ from software seller Softcat (SCT), say analysts, and that should power the shares beyond £20 for the first time this year.

Analysts at Peel Hunt and Numis had to rip up profit forecasts after the company massively outstripped first-half operating profit expectations, making our buy the dip call in November hugely profitable. The stock had sunk to £11.53, creating an opportunity for investors to ride a 54% rally in four months.

In the six months to 31 January 2021 revenue jumped 10% to £577 million while operating profit jumped 41% to £57.1 million, helped by cost savings. The interim dividend was hiked 18.5% to 6.4p per share and will be paid in May.

Numis analyst Tintin Stormont has raised her earnings before interest and tax and gross profit estimates right out to full year 31 July 2023.

A backdated staff pay rise, delayed because of Covid, and a few other operating expenses will flow through later this year and next but, as Peel Hunt pointed out, the company has huge room to grow with an estimated wallet share (i.e, how much an existing customer spends with Softcat rather than competitors) of just 15% to 20% right now.

SHARES SAYS: Still a great buy for the long term.

‹ Previous2021-04-01Next ›

magazine

magazine