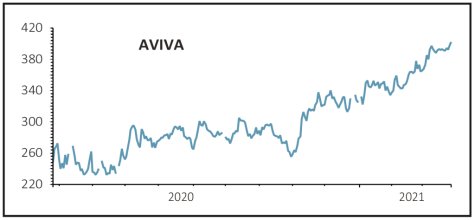

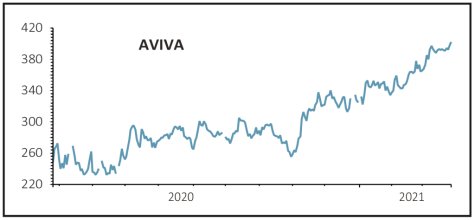

Aviva (AV.) 409.7p

Gain to date: 36.1%

Original entry point: Buy at 301p, 17 September 2020

With the sale of the Polish business to Germany’s Allianz for €2.5 billion, new chief executive Amanda Blanc has fully delivered on her promise to reshape insurer Aviva (AV.) as a focused business with significant shareholder returns.

The deal marks an eighth disposal in eight months, for a total cash inflow of €7.5bn, and has seen Aviva retreat from markets as diverse as Portugal, Turkey and Singapore.

With the shares trading at year-highs it’s tempting to think that’s it for now and lock in some gains, but given the speed and dexterity with which the non-core assets have been jettisoned we think it’s worth sticking around to see what Blanc has planned in order to reinvigorate the core UK, Irish and Canadian franchises.

For income investors there is a 6.4% dividend yield, while share buybacks will increase the net asset value – which already stands at close to 500p – still further.

Investment bank Berenberg has pencilled in £1.5 billion of share repurchases for the next financial year and a further £1.5 billion for the year after, which equates to roughly 20% of Aviva’s current market cap.

SHARES SAYS: Buybacks and dividends mean the stock offers one of the most attractive total return upsides in the FTSE, which is a good reason to stick with it.

‹ Previous2021-04-01Next ›

magazine

magazine