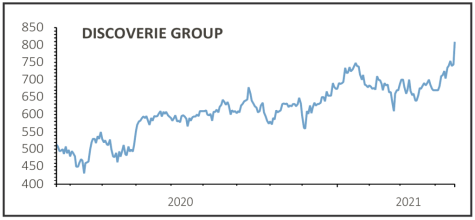

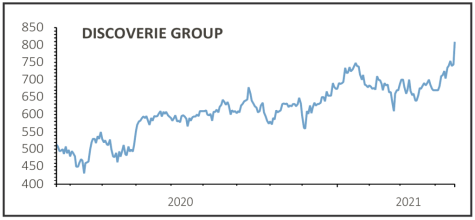

DiscoverIE (DSCV) 797p

Gain to date: 32.8%

Original entry point: Buy at 600p, 10 December 2020

Electronics engineer DiscoverIE (DSCV) is riding high after its latest trading update drove material upgrades to analysts’ earnings forecasts.

The company designs and manufactures bespoke kit for highly regulated industries including healthcare, renewables, transport and aerospace.

On 20 April the company said it expected underlying earnings for the 12 months to 31 March 2021 to be above the upper end of market expectations as trading momentum in the final two months of the year continued to strengthen.

Group sales in the second half were 9% ahead of the first half with a return to organic growth of 1% in the last two months of the year, with overall group sales for the full year 3% lower.

‘The strong order book and momentum provide a solid base for sustained organic sales growth whilst further investing in growth initiatives,’ the company said.

Broker Peel Hunt upgraded its March 2021 and March 2022 pre-tax profit forecasts by 8% apiece to £29.6 million and £32.3 million respectively.

Based on the upgraded forecasts for March 2022, the shares trade on a price to earnings ratio of 29.9.

SHARES SAYS: While the shares trade on a rich rating, we’re happy to stick with them while there is positive earnings momentum.

‹ Previous2021-04-22Next ›

magazine

magazine