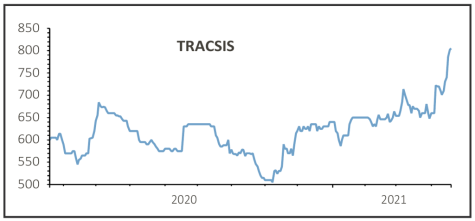

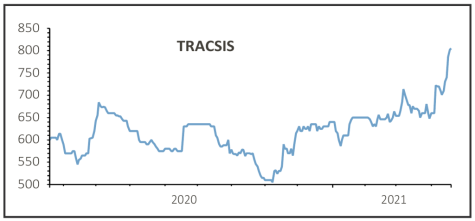

Tracsis (TRCS:AIM) 820p

Gain to date: 30.2%

Original entry point: Buy at 630p, 23 December 2020

Investors are getting far more confident that big events will get back going again this summer as the UK’s vaccine rollout filters through the population, and investors have been snapping up Tracsis (TRCS:AIM) stock in anticipation. About half of the Leeds-based transport infrastructure and analytics software company’s business comes from planning and running music festivals, motor races and other major events that attract people in their thousands.

Investors are getting far more confident that big events will get back going again this summer as the UK’s vaccine rollout filters through the population, and investors have been snapping up Tracsis (TRCS:AIM) stock in anticipation. About half of the Leeds-based transport infrastructure and analytics software company’s business comes from planning and running music festivals, motor races and other major events that attract people in their thousands.

Reopening came too late to save Glastonbury this year but there is optimism that events later in the summer will go ahead, such as the world-renowned Isle of Wight Festival, pencilled in for mid-September.

Tracsis management remain understandably cautious given the difficulty of predicting the Covid virus impact over the coming weeks and months, yet the company remains convinced of hitting its own 10% organic revenue growth target this year to 31 July 2021.

With a little luck and sensible precautions, getting some ‘live’ shows going this summer could push performance beyond that, and importantly, spark a series of upgrades for fiscal 2022, helped by roughly £2.5 million of costs permanently stripped out of the business.

SHARES SAYS: The stock is up 25% since the end of March, and this could be the start of a run of positive news events.

‹ Previous2021-04-22Next ›

magazine

magazine Investors are getting far more confident that big events will get back going again this summer as the UK’s vaccine rollout filters through the population, and investors have been snapping up Tracsis (

Investors are getting far more confident that big events will get back going again this summer as the UK’s vaccine rollout filters through the population, and investors have been snapping up Tracsis (