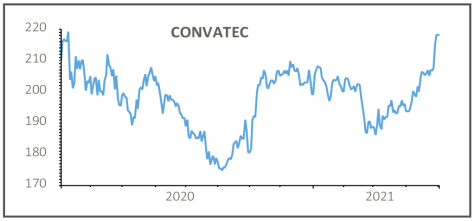

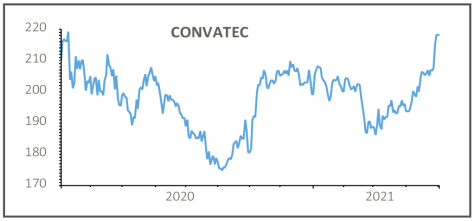

ConvaTec (CTEC) 223.8p

Gain to date: 9.3%

Shares in medical products firm Convatec (CTEC) are finally picking up, having been a laggard earlier this year thanks to a mix of sentiment shifting in favour of value stocks and concerns around pandemic-related disruption to the business.

Its latest update (29 Apr) seems to have won back the market’s attention. The company reported an 8.7% rise in revenue in the first quarter to $500 million, led by growth in its advanced wound care and infusion care business.

Advanced wound care revenue was up 8.8% on a reported basis, while ostomy care, its second largest business was up by 6.7%. Infusion care revenue increased by 13.9%, and continence and critical care revenue was up by 7.4%.

The company has maintained its full year outlook, citing ongoing macro uncertainties. For 2021, organic revenue growth is expected to be between 3% and 4.5%.

Numis analyst Paul Cudden says the numbers ‘provide further evidence that the turnaround has stuck’, adding that guidance looks ‘very conservative’.

SHARES SAYS: Convatec should benefit through the remainder of 2021 as elective surgeries delayed by Covid proceed. As a result, there’s a good chance of earnings upgrades. Buy.

‹ Previous2021-05-06Next ›

magazine

magazine