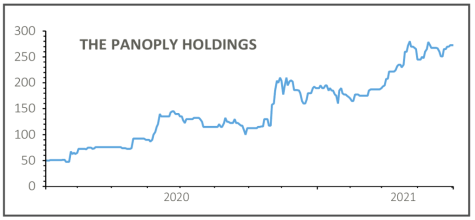

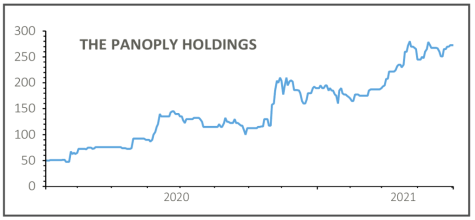

The Panoply Holdings (TPX:AIM) 273p

Gain to date: 203%

Original entry point: Buy at 90p, 6 August 2020

Analysts at Liberum recently called The Panoply Holdings (TPX:AIM) ‘the best way to play public sector digitisation’ and coming just days after another upbeat trading update, they have a point.

Back in August 2020 we said that the company had ‘substantial promise to become an investment star right at the heart of this trend’. Since then business has boomed and the share price has soared.

Its most recent update (26 Mar) revealed that revenue and adjusted earnings before interest, tax, depreciation and amortisation would be ‘not less than’ £51 million and £6.9 million respectively for the year to 31 March 2021.

Stifel, one of the brokers that provides forecasts, had previously pencilled in £48.5 million and £6.6 million, but bear in mind that the broker had already upgraded its estimates as recently as early March, following the £26 million Keep It Simple acquisition.

‘As one year ends positively, another starts positively,’ Stifel said in its note to clients, flagging Panoply’s £39 million workload backlog for the current year and a ‘strong pipeline that supports further organic growth in full year 2022’.

SHARES SAYS: Even after the stock’s stunning run, we think there is more to come. Still a buy.

‹ Previous2021-05-06Next ›

magazine

magazine