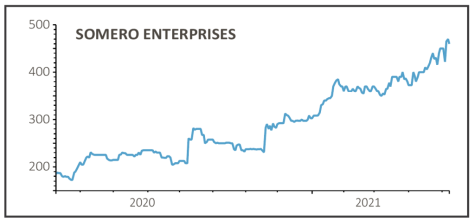

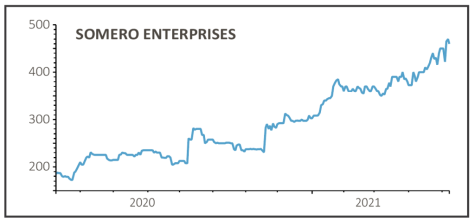

SOMERO ENTERPRISES (SOM:AIM) 459.49p

Gain to date: 76.7%

Original entry point: Buy at 260p, 24 September 2020

Online shopping has boomed during the Covid-19 pandemic and that success has manifested itself in some surprising ways, such as the soaring share price of concrete floor flattening equipment maker Somero Enterprises (SOM:AIM).

Demand has improved across the construction industry, but the real engine for improving trading conditions is the rampant need for more warehouse space as businesses embrace digital commerce.

Large modern warehouses and fulfilment centres increasingly use automation and robotics. To work they need to move swiftly and smoothly around the property, and that means level flooring to the nth degree, which is exactly where Somero comes in.

The company has hiked its 2021 growth guidance thanks to surging demand in its key US market as the economy bounces back. That was responsible for the stock’s latest lift, but the share price has been doing well for months, up nearly 80% since we said to buy last September.

SHARES SAYS: Somero’s superior margins (around 30%), strong cash generation and a near-20% price to earnings discount to peers is attractive. The company looks increasingly like a buyout target to us, so keep buying. [SF]

‹ Previous2021-05-13Next ›

magazine

magazine