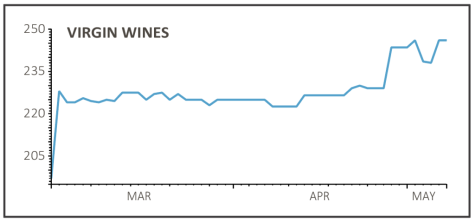

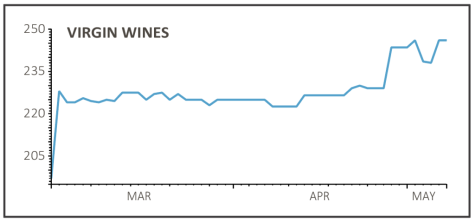

VIRGIN WINES (VINO:AIM) 246p

Gain to date: 9.8%

Original entry point: Buy at 224p, 22 April 2021

Our bullish call on stock market newcomer Virgin Wines (VINO:AIM) is 9.8% in the money and we are encouraged by an upgraded outlook (6 May) from the online wine retailer, which now sees year to June 2021 sales and profitability coming in ahead of its previous expectations.

The strong sales momentum experienced in the first half has continued into the second half to date, with Virgin Wines benefiting from ‘pleasing order frequency among existing customers and good levels of new customer acquisitions’ and enjoying growth in its new range of beers and spirits too.

Management now expects turnover for the year to be ‘no less than £73 million’, 4% ahead of broker Liberum’s previous estimates, with an improvement in EBITDA margin.

Admittedly, the easing of lockdown restrictions could impact on consumer spending patterns over the months to come, yet Virgin Wines remains confident that the underlying growth drivers alongside the accelerated shift in consumer behaviour towards online retailing will continue.

Liberum has increased its 2021 sales and pre-tax profit estimates from £70.3 million to £73 million and from £4.6 million to £5 million respectively.

SHARES SAYS: Keep buying Virgin Wines.

‹ Previous2021-05-13Next ›

magazine

magazine