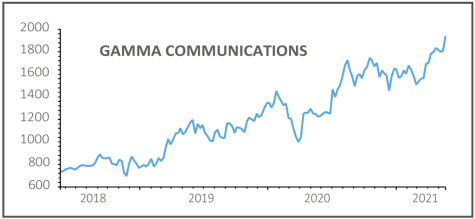

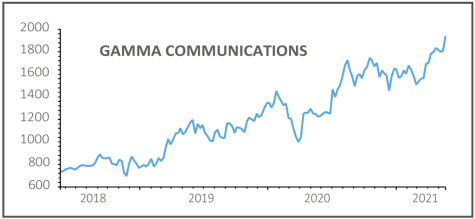

Gamma Communications (GAMA:AIM) £19.40

Gain to date: 30%

Original entry point: Buy at £14.95, 9 July 2020

Communications technology developer Gamma Communications (GAMA:AIM) continues to cement its reputation as a sleep easy investment for shareholders to own.

Its share price has stayed impressively resilient in the face of volatility hitting markets this year.

Gamma’s latest trading update (20 May) highlighted continued growth and, assuming no further lockdowns, that full year to 31 December 2021 results will be at the higher end of market forecasts.

The forecast range is £442 million to £461 million of revenue on earnings before interest, tax, depreciation and amortisation of £86 million to £94 million. This implies approximately 14% growth on both metrics at the mid points. For context, Gamma did £393.8 million sales and £79 million earnings before interest, tax, depreciation and amortisation in 2020.

Progressive Equity Research has left its forecasts untouched, but comments: ‘Gamma continues to exhibit its resilience in the current operating environment as its bad debts remain at low levels, and it retains a range of growth opportunities in both the UK and European unified communications markets.’

SHARES SAYS: A quality business still worth buying for the long run.

‹ Previous2021-05-27Next ›

magazine

magazine