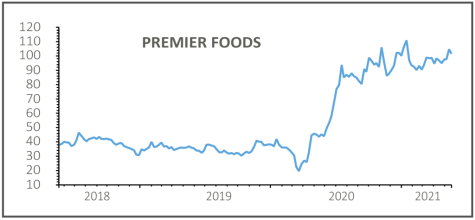

Premier Foods (PFD) 112p

Gain to date: 170%

Original entry point: Buy at 41.45p, 23 April 2020

Mr Kipling cakes-to-Sharwood’s sauces maker Premier Foods (PFD) continues to stage an impressive recovery and we think there could soon be revived bid interest in the stock.

Premier Foods spurned multiple bids from US spices giant McCormick & Co back in 2016. It is now in better financial and operational shape, meaning a bidder could pick up a much stronger business.

The latest round of profit upgrades for Premier Foods followed an increased bond issue that reduces Premier Foods’ finance costs, as well as good full-year results (19 May) that included a welcome return to paying dividends, a clear sign of the group’s dramatically improved financial health.

Once over-indebted, Premier Foods has reduced its leverage to its lowest-ever level, which will allow it to invest in its brands and new product categories.

Shore Capital believes Premier Foods remains undervalued, even after the strong share price performance over the past year, given its ‘ongoing focus upon supporting its brand portfolio in the UK and now a little more further afield, plus the scope for complementary bolt-on acquisitions and the return to the dividend roster’.

SHARES SAYS: Keep buying Premier Foods for its strengthened balance sheet, improving profit performance and the potential rekindling of bid interest.

‹ Previous2021-05-27Next ›

magazine

magazine