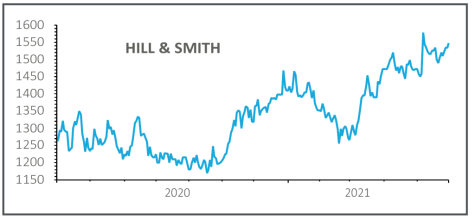

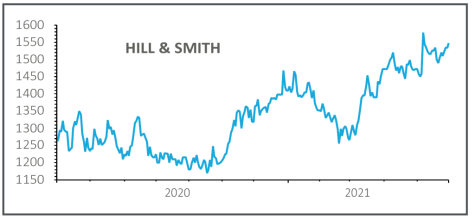

Hill & Smith (HILS): £15.34

Gain to date: 0.9%

Original entry point £15.20, 20 May 2021

Infrastructure equipment firm Hill & Smith (HILS) revealed last week revenues in the first four months of the year were 10% above 2020 and were also ahead of 2019 levels.

The roads division was the main driver of the growth in turnover thanks to ‘high levels of demand’ in the US, a ‘solid’ performance in the UK and a ‘robust’ recovery in its international arm.

Meanwhile, the utilities division put in a strong performance, due to a ‘good recovery’ in demand for engineered pipe supports and reinforced composite products, and volumes in the galvanizing division were ‘significantly higher’ than 2020.

The firm also pointed to ‘a strong recovery in operating profit’, helped by the closure of a small loss-making unit in the UK, and said it had increased confidence in its full year earnings guidance.

Analysts at Jefferies believe the upbeat commentary and the prospect of major infrastructure spending to come in the US, could encourage a re-rating of the shares. ‘The more we read the trading update, the more impressed we are’, they add.

SHARES SAYS: There are signs the new chief executive has already begun the process of improving the quality of the portfolio, as investors had hoped.

‹ Previous2021-06-03Next ›

magazine

magazine