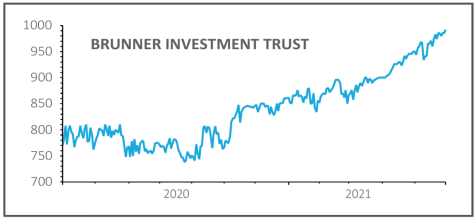

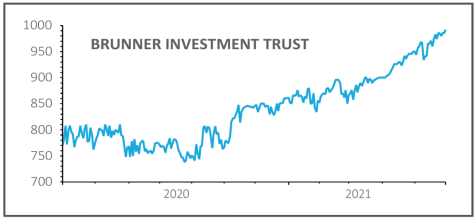

Brunner Investment Trust (BUT): 986p

Gain to date: 14.4%

Original entry point: Buy at 862p, 28 January 2021

With its focus on large, well-capitalised businesses which serve global markets and have pricing power, the trust has had a good start to the year, outpacing the FTSE World ex-UK index and the global investment trust sector.

Over one month, three months and six months, the shares have returned 4.5%, 15.9% and 17.5% respectively, putting them in the top quartile for performance.

The shares trade at 986p but the net asset value is £10.87, meaning the shares are trading at a discount of more than 9% which is unusually large for a blue-chip investment trust.

Now that major investor Aviva (AV.) has finished selling down its holding – documents show it held just 0.2% of the shares in mid-April compared with 10.58% at the start of the year – the ‘overhang’ which had held the stock back has been removed.

Regarding the markets, manager Matthew Tillett observes that ‘after a very substantial re-rating, equity markets have now largely priced in the near-term economic recovery’.

‘We’re focused on 2022 and beyond. Resilient business models that continue to deliver reliable growth will lead the market, even if many have been out of favour in recent months,’ he adds.

SHARES SAYS: The removal of the share overhang is a key milestone for the trust. We’re pleased to see strong performance and believe Brunner should continue to reward investors.

‹ Previous2021-06-03Next ›

magazine

magazine