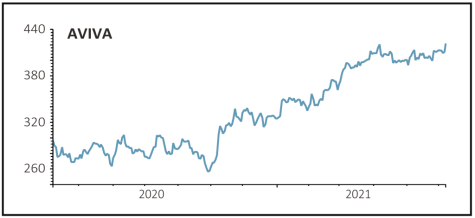

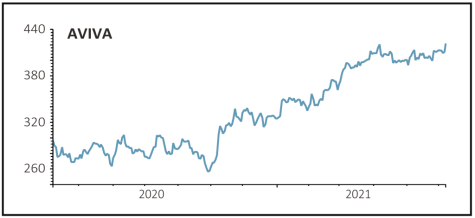

Aviva (AV.) 425.6p

Gain to date: 41.4%

Original entry point: Buy at 301p, 17 September 2020

Our positive call on insurance firm Aviva (AV.) continues to be richly rewarded with stake building by activist investor Cevian acting as the latest catalyst for the share price.

Chief executive Amanda Blanc, who took over the helm in July 2020, has already disposed of eight businesses for more than £7.5 billion and has pledged to return cash to shareholders, although has not specified a figure.

Cevian clearly likes the general direction Blanc is taking the business, as it is not calling for a change at the top, but it wants her to go further and faster.

The Swedish investment firm said Aviva should return £5 billion of excess capital in 2022 and target cost cuts of at least £500 million by 2023. Aviva last year said it was targeting £300 million worth of cost cutting by 2022.

Cevian says the business should have a value of more than 800p per share within three years and should more than double its dividend to 45p, equating to a yield of more than 10% on the current share price.

SHARES SAYS: The latest developments should give the share price a further leg up. Stick with the shares to see if Cevian can influence change.

‹ Previous2021-06-10Next ›

magazine

magazine