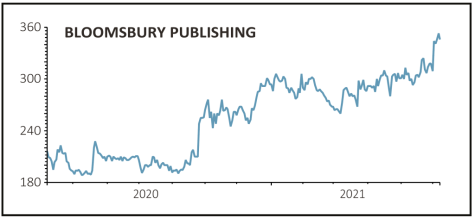

Bloomsbury (BMY) 350p

Gain to date: 23.3%

Original entry point: Buy at 283.84p, 4 February 2021

When we added publishing group Bloomsbury (BMY) to our Great Ideas list in February the company had already enjoyed a strong share price run. Our view that the lockdown-inspired boom in reading would continue has been borne out.

Results for the 12 months to February 2021 were ahead of estimates on almost every level with sales increasing 14% to a record £185.1 million and pre-tax profit up 22% to £19.2 million. What’s more, the company noted a strong start to the current financial year and said it expected revenue to be ‘ahead’ and profit to be ‘comfortably ahead’ of expectations.

Thanks to its strong financial position and cash generation, Bloomsbury was able to not only increase the final dividend by 10% to 7.58p, but also propose a special dividend of 9.78p.

Numis upgraded its February 2022 earnings per share forecast by 13% from 15.7p to 17.7p which puts the shares on a price to earnings multiple of 19.8 times.

Analyst Steve Liechti said the £8.5 million acquisition of Head of Zeus, announced alongside the numbers, ‘looks an interesting UK consumer publishing bolt-on’.

SHARES SAYS: We remain positive on the shares.

‹ Previous2021-06-10Next ›

magazine

magazine