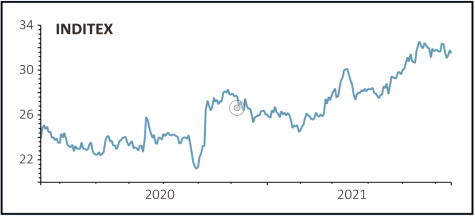

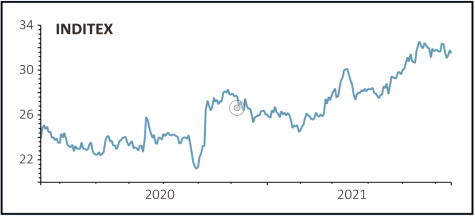

Inditex (ITX:BME) €31.75

Gain to date: 32.3%

Original entry point: Buy at €24, 8 October 2020

Shares in Spanish fashion firm Inditex, which owns the iconic Zara brand along with half a dozen lesser-known (in the UK) brands, continue to enjoy a re-rating after the firm beat forecasts with a return to profit in its first quarter.

Despite losing a quarter of trading hours due to a high number of its stores still being closed, sales in the three months to April increased by 50% to €4.94 billion thanks to a 67% surge in online revenues.

Also, while almost a fifth of its stores remained shut at the end of April, the company stuck to its expansion plan and managed to open new stores in 21 countries.

Even after this investment, net cash at the end of April was €7.2 billion, up 25% on last year and the highest-ever first quarter level for the business.

Strong trading continued into May with sales online and in-store up 102% on last year and 5% ahead of the same month in 2019, even with a 10% reduction in trading hours due to many stores still being closed.

Analysts have rushed to upgrade their earnings forecasts, yet a number are stoically sticking with their ‘hold’ recommendation despite the shares trading above their target prices. We expect them to capitulate in time.

SHARES SAYS: We expect the company to keep beating expectations. Stick with the stock.

‹ Previous2021-06-17Next ›

magazine

magazine