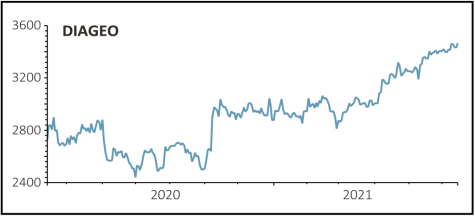

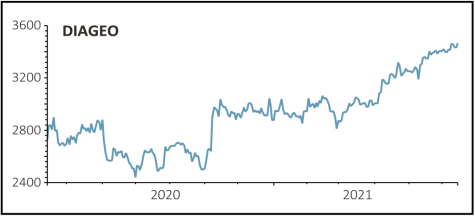

Diageo (DGE) £34.60

Gain to date: 17.5%

Original entry point: Buy at £29.45, 23 December 2020

We are not the only ones to have spotted potential in alcoholic drinks giant Diageo (DGE) with Nick Train’s Lindsell Train Global Equity Fund (B644PG0) noting the recent uptick in performance in its latest factsheet.

Train’s colleague Michael Lindsell commented that the company has come a long way since the early stages of the pandemic: ‘Now, one year on, the clouds have parted,’ he said.

‘Based at home, consumers have guzzled spirits with unanticipated enthusiasm, buying into the trend for cocktails and premium offerings. Organic sales have started to recover, up 1% in the last half of 2020 with further momentum building since.

‘Reinforcing a five-year trend, spirits as an alcoholic beverage category continues to take share from beer and wine.’

Lindsell also noted the strong performance of tequila which is making the purchase of Casamigos, albeit at a high price, in 2017 look ‘well-timed’. And he is encouraged by the recent purchase of premium gin brand Aviator Gin, observing that 60% of revenue is now derived from premium products.

SHARES SAYS: Like Lindsell Train we are encouraged by recent performance and still think the shares are worth buying.

‹ Previous2021-06-17Next ›

magazine

magazine