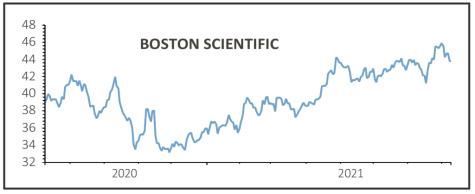

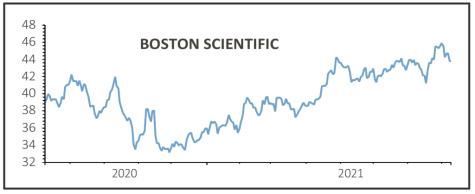

Boston Scientific $43.81

Gain to date: 31.4%

Original entry point: Buy at $33.33, 26 November 2020

As hospitals around the world start to make elective procedures the priority after months of Covid-19 issues, demand for medical equipment firm Boston Scientific’s kit and services is starting to pick-up. The $62 billion company reported second-quarter profit and revenue that beat expectations and raised its full-year outlook.

The medical technology company swung to net income of $172 million, or $0.12 a share, from a loss of $153 million ($0.11 a share) last year. Strip out one-offs, adjusted earnings per share were $0.40 cents, topping the $0.37 consensus. Revenue rose 54% to $3.08 billion, above $2.94 billion consensus, while its core cardiovascular revenue jumped more than 50%.

Boston Scientific’s stock has rallied more than 24% in 2021 so far and investors have reason to keep backing the shares given that the company raised its guidance ranges for adjusted earnings per share (from $1.53 to $1.60, now $1.58 to $1.62) and for revenue growth, which is now expected to jump by more than 20%.

SHARES SAYS: Boston is reclaiming its markets, growing into new ones (prostate health, therapeutic oncology, for example) and widening its market base into China, India, and Malaysia. Still a buy.

‹ Previous2021-08-12Next ›

magazine

magazine