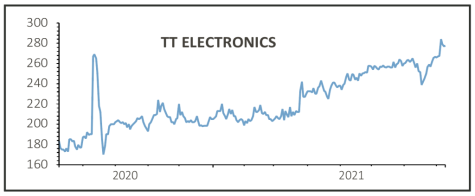

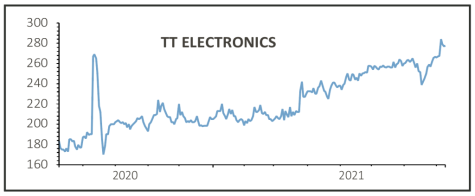

TT Electronics (TTG) 277.5p

Gain to date: 31.5%

Original entry point: Buy at 211p, 25 March 2021

Engineer TT Electronics (TTG) is racing ahead as it goes far beyond the traditional sensors and instrumentation markets that it used to bank on, with fast-growing, and more profitable, digital areas very much becoming part of the recovery and growth story.

This includes supplying complex connectivity, automation and machine learning components and systems for industrial, renewables and medical applications, and strong interim results demonstrate the strategic progress that has been made, underpinning ‘confidence on the path to double-digit margins, which we currently estimate in full year 2023,’ spell out analysts at Numis.

TT started the second half with a record order book and of higher quality, with a first half book to bill of 134%, which means that 2021 forecast revenues of £481 million (Numis estimate) are already fully covered. There’s some very decent visibility also being built up into 2022. Most of the company’s restructuring will be finished this year and with improved end markets, more profitable business mix and operating margins (8% first half) heading north, TT looks in a great place.

SHARES SAYS: Numis anticipates another 20% upside from the shares, keep buying.

‹ Previous2021-08-12Next ›

magazine

magazine