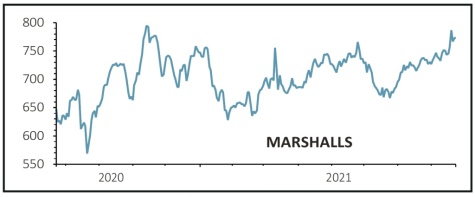

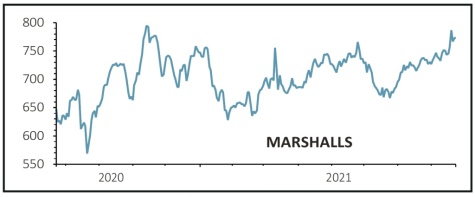

Marshalls (MSLH) 771p

Gain to date: 20.7%

Our buy call on building products group Marshalls (MSLH) has already delivered the same return in six months as the shares normally generate in a year, thanks to strong trading across its two primary divisions.

Sales to the public sector and commercial market were up 40% in the first half to June as the new build housing market continues to grow and the firm wins a greater share of public works, courtesy of its collaboration with architects to incorporate its products from the design stage.

Meanwhile, sales to the domestic market jumped 57% as the repair, maintenance and improvement market continues to experience high levels of demand. Many households have more disposable income due to not commuting and are spending more time at home so they are happy to spend money on improving their outdoor space.

According to chief executive Martyn Coffey, the current 21-week order book with the firm’s installers is a record and there is no sign of the RMI market slowing any time soon.

As a result of this continued strength of demand and positive trading in its end markets, the firm has raised its earnings guidance for this year and next year, spurring yet another round of upgrades from brokers.

SHARES SAYS: We’re sticking with our call on Marshalls and would add on any weakness.

‹ Previous2021-08-26Next ›

magazine

magazine