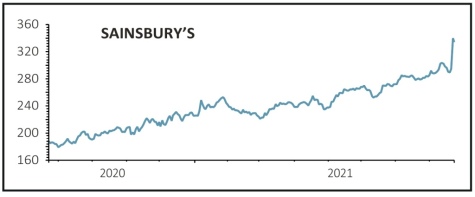

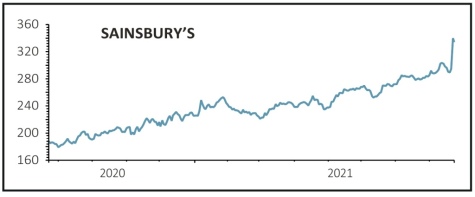

Sainsbury’s (SBRY) 332p

Gain to date: 39.5%

When we recommended Sainsbury’s (SBRY) back in January we were attracted by the valuation and its robust sales performance over the Christmas trading period, which suggested the firm’s investment in its online operation in particular was bearing fruit.

Also, the Argos non-food business put in a strong showing thanks to its success in converting in-store shoppers into online buyers during the pandemic, vindicating the controversial decision to close more than 400 physical shops.

The shares have seen steady buying over the summer as overseas investors looked to scoop up UK stocks trading at a discount to their US and European counterparts.

Meanwhile, the firm has outperformed its rivals, increasing its share of the UK grocery market from 14.9% this time a year ago to 15.2% currently, according to consultancy Kantar Worldpanel.

Moreover, sales in the first quarter to the end of June were sufficiently strong for the firm to upgrade its full year earnings forecast, which on paper could mean an increase in the dividend payout.

More recently, the M&A activity elsewhere in the sector has highlighted Sainsbury’s attractive valuation and bid talk has resurfaced, with suggestions US private equity firm Apollo, which has previous form in bidding for UK supermarkets, could be lining up an offer.

SHARES SAYS: We think Sainsbury’s strong run has further to go.

‹ Previous2021-08-26Next ›

magazine

magazine