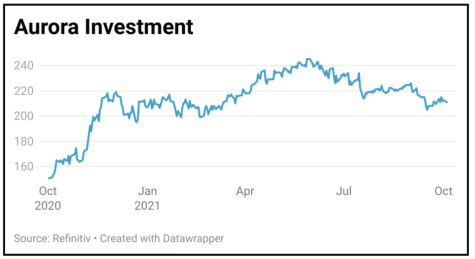

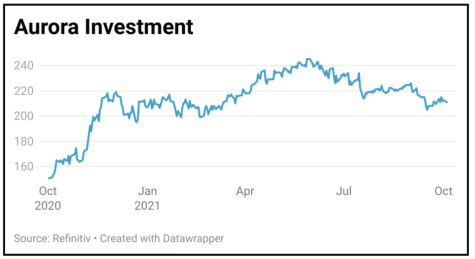

Aurora Investment Trust (ARR) 214.3p

Gain to date: 26.8%

Original entry point: Buy at 169p, 22 October 2020

A rotation out of value and back into growth saw our gains on Aurora Investment Trust (ARR) eroded in recent months but signs that bargain stocks are back in favour could help reverse this trend.

The first half results revealed an 8.5% increase in its net asset value, lagging the FTSE All-Share’s commensurate 11.1% return.

However, with a shift in sentiment potentially helping Aurora, this underperformance could well be turned on its head in the second half.

Post the period end shareholders approved Aurora’s investment in sister fund Castelnau, an investment trust which will also be run by Phoenix Asset Management.

Castelnau is set to account for 15% of Aurora’s holdings and it will hold a mixture of quoted and unquoted businesses, some of which are currently held directly by Aurora but those positions will be exchanged for shares in the new vehicle.

The new investment trust’s strategy is to revamp old-fashioned British businesses, including names such as toy train outfit Hornby (HRN:AIM) and stamp dealer Stanley Gibbons (SGI:AIM). Read more about Castelnau, which floats on 18 October, here.

SHARES SAYS: We remain fans of Aurora’s approach of buying solid, undervalued businesses. Buy.

‹ Previous2021-10-07Next ›

magazine

magazine