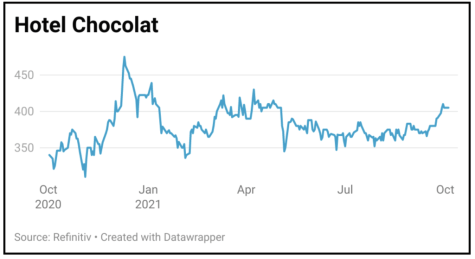

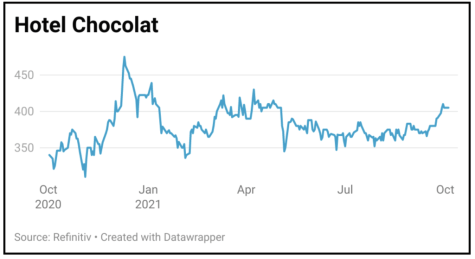

HOTEL CHOCOLAT (HOTC:AIM) 437.5p

Gain to date: 17.9%

Original entry point: Buy at 371p, 29 July 2021

Our bullish call on luxury chocolatier Hotel Chocolat (HOTC:AIM) is performing very strongly despite a challenging backdrop.

The shares were marked higher on forecast-beating full year earnings (5 Oct) and news of a robust start to the new financial year.

Despite the physical store estate being closed for six months of the year ended 27 June 2021, Hotel Chocolat delivered revenue growth of 21% to £165 million while pre-tax profit jumped from £2.4 million to £10.1 million, comfortably ahead of analysts’ forecasts, as rapid-fire digital growth more than offset retail disruption.

Growing the active customer database, Hotel Chocolat is making good progress in its two new and sizeable markets of the US and Japan and has also ramped up its commitment to becoming the world’s most sustainable chocolate brand through the introduction of its ‘Gentle Farming Charter’.

Liberum Capital believes the company generated ‘very strong double-digit growth’ in the opening 13 weeks of the new financial year and is excited about Hotel Chocolat’s upcoming first TV campaign for the Velvetiser in-home hot chocolate system. The broker has a ‘buy’ rating and 620p price target on Hotel Chocolat, implying almost 42% upside from current share price levels.

SHARES SAYS: Stick with Hotel Chocolat.

‹ Previous2021-10-07Next ›

magazine

magazine