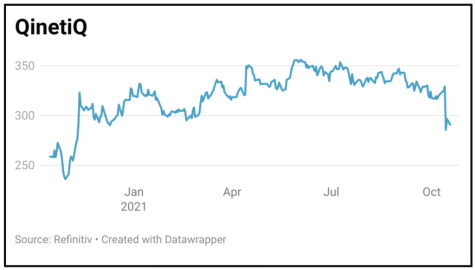

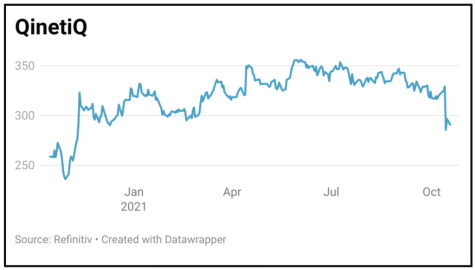

QinetiQ (QQ.) 290.8p

Loss to date: 2.74%

Original entry point: Buy at 23 December 2020 at 299p

Defence and cyber security company QinetiQ (QQ.) surprised investors on 14 October when it flagged a supply chain issue relating to a large complex multi-year programme, sending the shares 13% lower.

The company said it was making progress with the client towards a recovery of the programme which is expected to mitigate the risk to less than £15 million.

Analyst Richard Palge at Numis said he was hoping that QinetiQ’s management were following past behaviour and being highly conservative in their financial assessment.

QinetiQ will provide more details at its preliminary results on 11 November, but management seem confident that the issue is temporary and can be contained within the current financial year.

Indeed, medium term guidance was maintained and calls for mid-single-digit organic growth with strategic acquisitions adding on top and for an operating profit margin of between 12%-to-13%.

The supply chain issue detracted from a strong first half with order intake up 25% to £700 million year-on-year despite tough comparatives last time when orders grew 37%.

SHARES SAYS: QinetiQ remains a buy.

‹ Previous2021-10-21Next ›

magazine

magazine